why do tech stocks sell off when interest rates rise

First they increase the costs of borrowing more money to expand a business. 23 January 2022 519 pm 5-min read.

When the Federal Reserve raises interest rates it causes the stock market to go down.

. 39 minutes agoAnd given the secular growth industry that it participates in investors should expect to pay a richer price. Consumer staples non-cyclical investments. Conventional wisdom tells us that we should avoid tech stocks in an increasing interest rate scenario.

From July 25 2012 to 2013s end. As a general rule of thumb when the Federal Reserve cuts interest rates it causes the stock market to go up. There is no noticeable relationship whatsoever.

1 hour agoSnowflake SNOW. But non-cyclical or defensive stocks are more suitable before a. SP 500 tech earnings are less sensitive to changes in interest rates than are overall SP 500 earnings because tech companies have just over half the debt financing that the index ex-tech does.

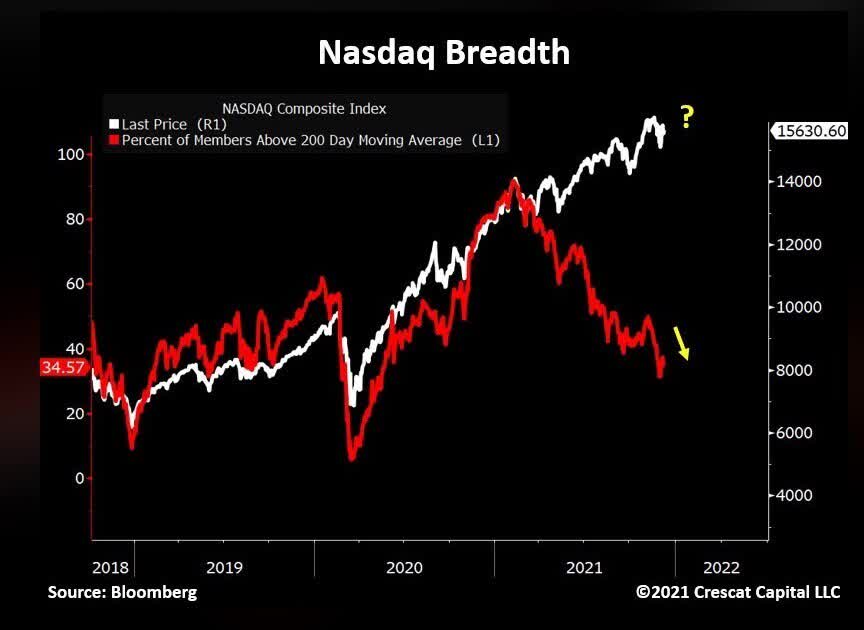

Recent history proves Tech can do just fine alongside rising rates. From the summer of 2016 through the winter of 2018 interest rates more than doubled from 14 to 32. AP Stock market-listed technology companies the world over have seen their share prices plummet in the first few weeks of 2022 as concerns over rising inflation scare off investors.

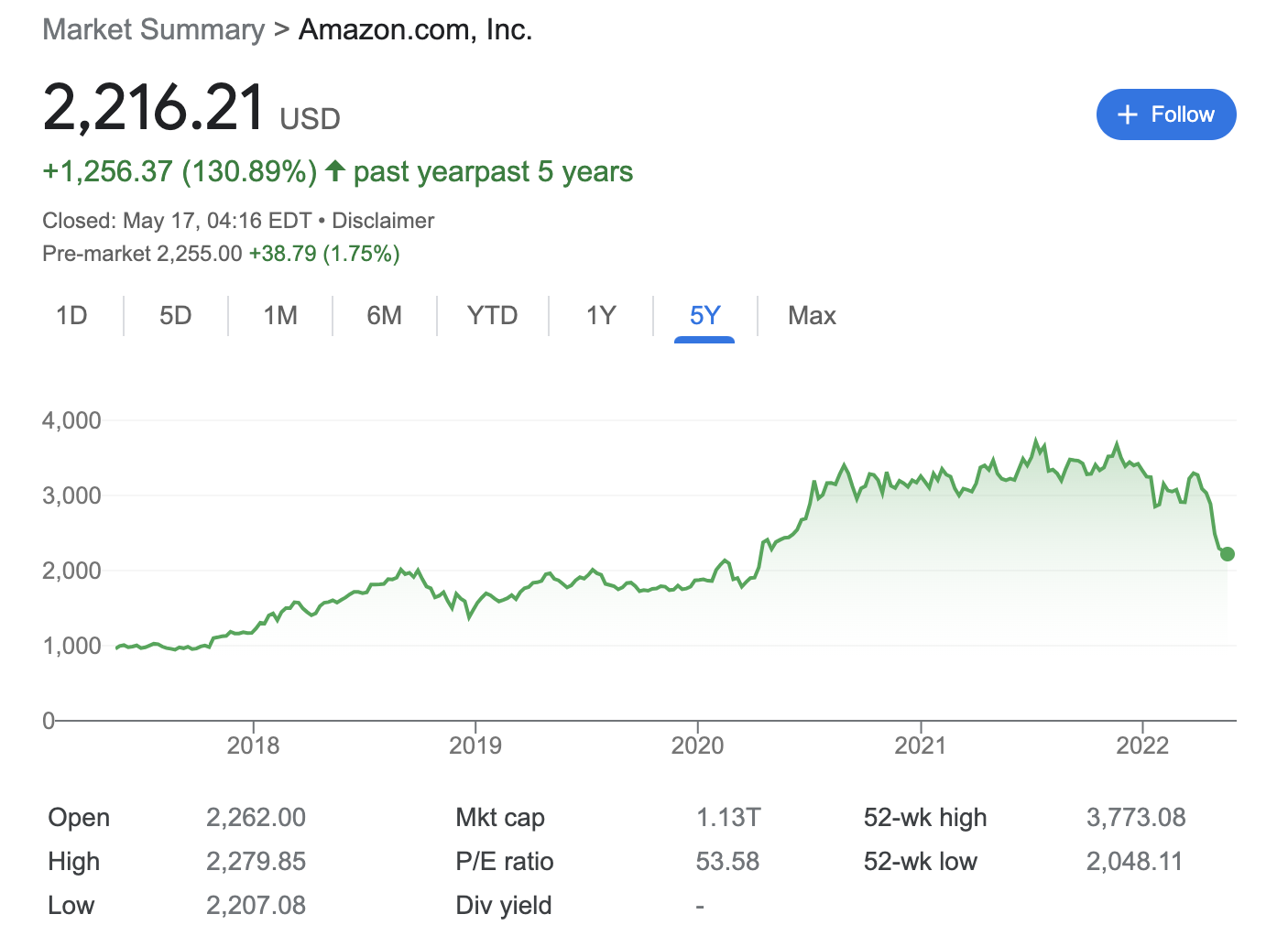

1 hour agoWhat yields are doing. Amazon is among the big tech stocks losing ground so far this year. When the interest rate starts to rise the downward pressures for such stocks are extremely high.

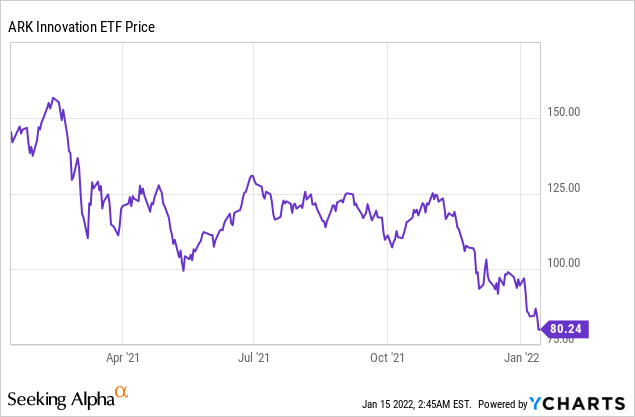

Fast-growing technology stocks have been slammed because of rising bond yields amid expectations for stronger economic growth. At 512 am. The bulk of the sell-off has been a combination of pricing in slowing economic growth and rising interest rates.

6 hours agoAmazon shares have fallen over 26 this year mired in the stock market selloff that has shaved over 23 off the tech-heavy Nasdaq Composite as investors wrestle with a slowing economy near. Consumer discretionary cyclical stocks will typically perform best during the peak times of the economic cycle and during the early stages of rising interest rates. Youd think a faster-growing economy would spur tech shares to ever.

That is well above the average analyst price target of 8073. But it works both ways. A simplified way to think about why bond prices fall when rates rise is this.

When the Federal Reserve raises interest rates it causes the stock. Here are a few stock sectors considered to be defensive investments. Fiverr International FVRR.

Shares of ExxonMobil are now up over 50 so far in 2022 as they once again reached fresh new highs at 9909. While members of the NYSE FANG index. In that time tech stocks got crushed crashing 80.

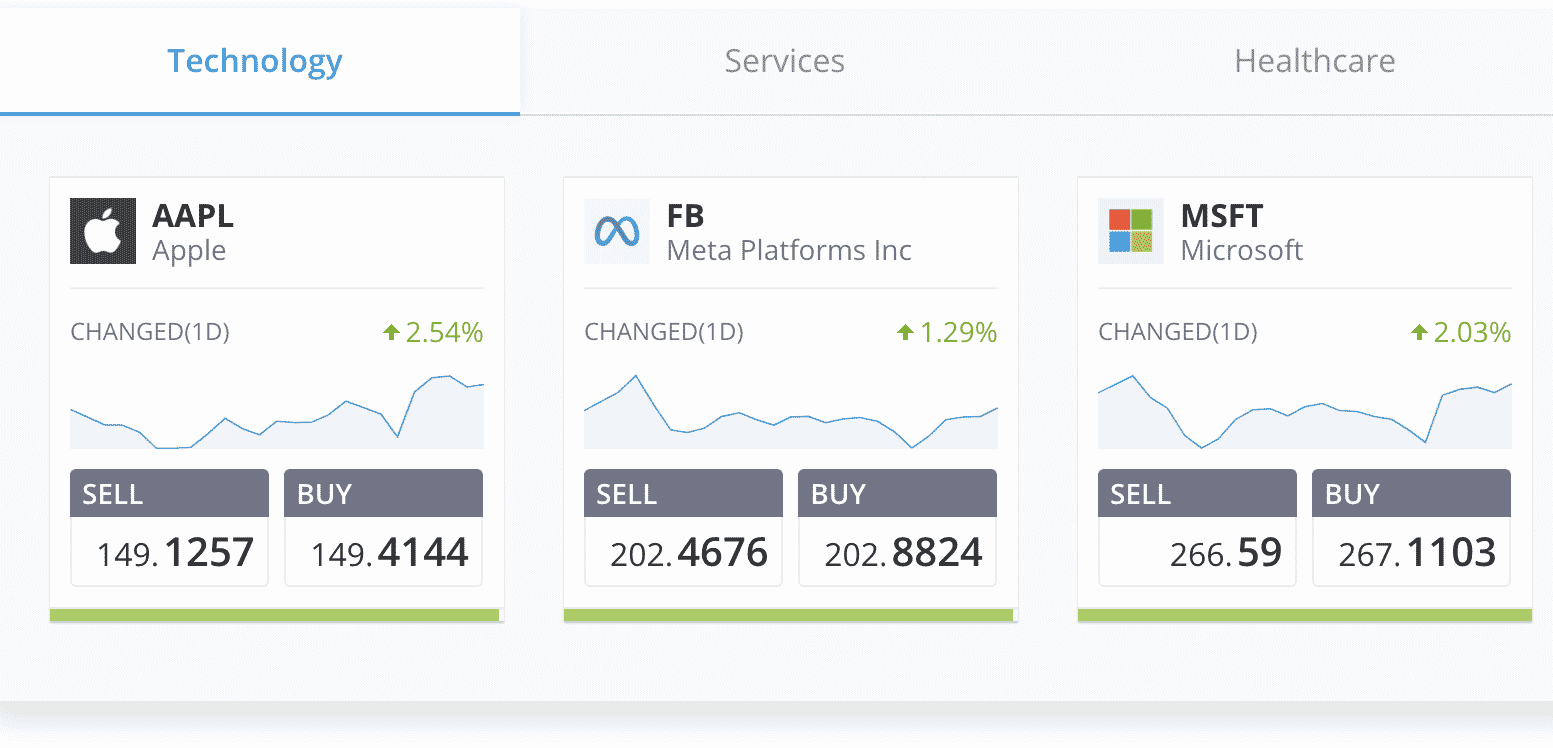

But higher interest rates can hurt growing tech companies in three ways. ET Dow e-minis were up 272 points or 083 SP 500 e-minis were up 45 points or 11 and Nasdaq 100 e-minis were up 18575 points or 148. Sometimes they move in opposite directions.

The big selloff in the technology sector isnt simply a US. Interest rates fell from 65 in the early-2000s to just over 3 a few short years later. A discount rate reduction has an exponential impact on stock prices due to the multiplier effect.

This puts pressure. Besides the analysts here are 5 really good reasons XOM and other big oil stocks like Chevron CVX are due. Crowding is a risk because it may mean that even a relatively minor negative news event for a tech leader could trigger a sell-off and a sharper-than-expected downdraft for the.

The NASDAQ 100 Technology index which. The yield on the 10-year Treasury note TMUBMUSD10Y 2963 was at 2952 versus 2955 at 3 pm. Growth and many technology stocks have been hit especially hard because of the long.

Monster growth stock which should continue benefitting from tailwinds in the business intelligence space. 5 rows Insurance stocks can flourish as why do tech stocks go down when interest rates rise. As well the stock market will start to re-value the stocks and downgrade the target prices.

High-flying equity valuations are getting a haircut. Top-tier freelancing marketplace with. Large-cap technology stocks usually are market leaders when interest rates are rising.

Thats bad news for high-growth tech companies. Yields and debt prices move opposite each other. Certainly XOM has been on a major bull run over the past year.

Remember at current levels with US 10-year bond yields still below 15 per cent a return to something even approaching a more normal rate of 3 per cent would see interest rates more than double. Why investors should not give up on tech stocks entirely as interest rates rise. Also Hammered as Interest Rates Rise.

A trader in a face mask works on the trading floor at the New York Stock Exchange NYSE as the Omicron coronavirus. However tech stocks are fundamental for healthy portfolio returns. Its down more than 50.

Broadly market heavyweights Apple. For bonds expectations of increasing interest rates mean investors in the primary market earn higher coupons on new issues. Tech stocks rose around 60 over this time frame.

Layoffs Stock Prices Dropping Hit Tech Companies Protocol

Tech Stocks Challenged But Not All Created Equal Www Principalglobal Com

Buy The Crash 2 Tech Stocks For 2022 Seeking Alpha

Rising Stock Market Would Be In The Red Without A Handful Of Familiar Names The Washington Post

Media Tech Stocks Slide U S Markets See Biggest Drop Since 2020 Variety

Why Have Tech Stocks Been Hit So Hard Morningstar

Live News From January 21 Global Stocks Notch Worst Week Since 2020 Us And Russia Plan Further Ukraine Talks After Blinken Lavrov Meeting Boe Policymaker Cautions On Wage And Price Expectations Financial Times

Best Tech Stocks To Buy In June 2022

Chart Big Tech In Unfamiliar Territory Statista

Despite Friday S Swoon We Re At A Bottom Buy These Beaten Down Big Cap Tech Stocks Seeking Alpha

Why Higher Bond Yields Are Bad News For Tech Stocks Like Amazon And Zoom Barron S

Top 5 Tech Stocks For 2022 Seeking Alpha

Why Are Tech Stocks Getting Murdered Observer

New York Ap U S Stocks Plunged Wednesday As Investors Fearful That Rising Interest Rates And Trade Tensions Could Hurt C Stock Market Tech Stocks Economy