capital gains tax changes 2021 canada

Her 2021 federal tax bill will increase by around 1000 to 8579 because of the change in the income tax bracket and the salary hike. After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on.

Best Robo Advisor In Canada 2021 A Chart Comparison Genymoney Ca Personal Finance Lessons Investing Personal Finance

Its been paying dividends for more than 140 years and increased the payment for 25 consecutive years.

. Also noted are changes to income tax rules including those that were announced but not yet law when the Income tax package was published in November 2021. Generally capital gains are taxed on half of the gain. For instance Emmas 2021 and 2022 taxable income remains.

You can do the paperwork once you have all the tax slips and file your 2020 tax return electronically. The Federal government website says the following about Capital Gains changes in 2021. This new proposed minimum tax appears to limit the benefits of all credits except for the foreign tax credit and would be calculated as 15 of taxable income for individuals in the top marginal tax bracket ie with taxable income in excess of 216511 for 2021.

If I include the BPA adjustment Wandas federal tax bill. In case your taxable income is less than 155625 you. There has been much anticipation and speculation regarding the upcoming Budget as the previous budget was.

Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. Canadas Deputy Prime Minister and Finance Minister Chrystia Freeland will deliver Canadas 2021 federal budget on April 19 2021. While we cant say for sure whether capital gains will be restricted or the GST will increase below we have covered the tax rate changes in Canada we know about so far for 2022.

Your earnings from the property and the cost of maintaining the property will not change the ACB. When this minimum tax is greater than the net federal tax it replaces the net federal tax and for. Under Canadian tax law only 50 of capital gains are taxable at your marginal rate.

If these changes become law as proposed or announced they will be effective for 2021 or as of the dates given. Prior to 1972 capital gains were not taxable in Canada. Federal Tax Rate Brackets in 2022.

Depending on your province of residence for high-income earners the marginal tax rate on capital gains in 2021 can be as high as 27. Guidance on affidavits and valuations Bill C-208. The CRA increased the basic personal amount by 590 to 14398 for 2022.

For tax purposes the gain would only be half of 35. Accordingly the actual income that you would be taxed on at your marginal tax rate would be 1750. If a change to the capital gain inclusion rate is announced in the upcoming budget it is.

In 2016 there. If you sold the property for 560000 you incurred a 35000 profit Capital Gains 560000 Proceeds 525000 ACB. The federal income tax brackets.

For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022. 15 rows In Canada 50 of the value of any capital gains is taxable. Upcoming Federal Budget April 19th Planning For Possible Capital Gains Tax Increase.

They have increased the Lifetime Capital Gains Exemption Limit LCGE For dispositions in 2020 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to. The changes are in effect for 2021 for the 202o tax year. In other words if you sell an.

For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of 35. Only half of it is taxable so you will add 17500 to your taxable income for the year. One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market.

For more information see What is the capital gains deduction limit. Capital Gains Tax Rate. On March 22 2021 the Finance Minister Chrystia Freeland finally announced the date of the federal budget the Budget to be April 19th 2021.

Lifetime capital gains exemption limit. In Canada 50 of the value of any capital gains are taxable. Increasing the capital gain inclusion rate may be one tax change the Canadian government could consider in order to boost tax revenues.

For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 892218. This has Canada speculating again if a hike to the capital gains inclusion rate may occur in the next federal budget. Tax changes and improvements to services are noted on this page.

Between 1984 and 1994 there was a 100000 lifetime capital gains exemption that applied broadly to most capital assets. The CRA has increased the 2022 age amount by 185 to 7898 which will reduce your federal tax bill by 1185 15 of 7898. As of September 7 2021 the share price is 3397 a.

The CRA declared Monday February 22 2021 as the official start of the 2021 tax season. 2021 Federal Budget Possible tax changes. Tax Changes in 2022.

2021 Federal Budget On the trail of possible tax changes.

Best Robo Advisor In Canada 2021 A Chart Comparison Genymoney Ca Personal Finance Lessons Investing Personal Finance

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Federal Budget Tax Changes 2021 Canada

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Understanding The Tfsa Updated For 2021 Tax Free Savings Finance Saving Savings Account

High Income Earners Need Specialized Advice Investment Executive

Singapore Is Turning Into An Attractive Location For Hnis Including Many From India With Laws Tailored To Attract Foreign Capi Singapore Student Entrepreneur

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

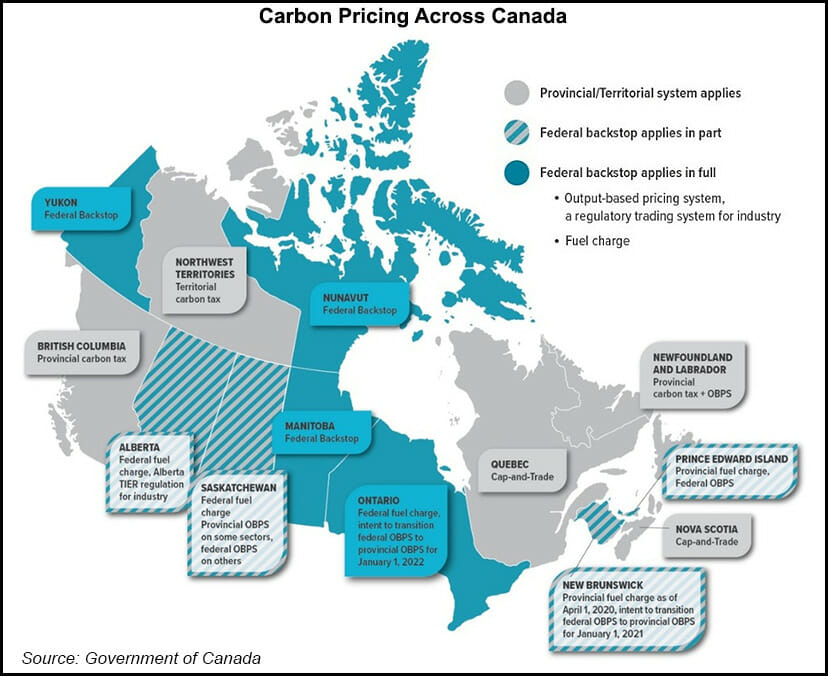

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Calculating Your Moving Costs Estate Tax Capital Gains Tax Money Market

Usa East West Division 4 Methods Map Amazing Maps American History Timeline

What Kind Of Business Insurance Do You Require Call Accountants Uk Business Insurance Business Insurance

Canadian Personal Tax Organizer In 2021 Tax Organization Tax Checklist Tax Return

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips